Charles Darwin never actually said:

“It is not the strongest of the species, nor the most intelligent that survives, but the one that is the most adaptable to change”. (“Six things Darwin never said – and one he did”, Darwin Correspondence Project, University of Cambridge ©2013)

So whoever baits you with this hook – from now on – you’ll know that there’s a sucker for uncritical consensus somewhere in the food chain.

“The work of science has nothing whatever to do with consensus. Consensus is the business of politics. Science, on the contrary, requires only one investigator who happens to be right, which means that he or she has results that are verifiable by reference to the real world. In science consensus is irrelevant. What is relevant is reproducible results.” (Michael Crichton, M.D.) Due diligence reveals, so often, that the DNA in so many intellectual pieties is bogus.

In what seems like another lifetime – almost 20 years ago – I was CFO of the Physician Practice at Columbia University’s College of Physicians and Surgeons. It was an outpatient practice for our attending physicians. They were already billing through the hospital for their in-patient rounds and procedures. Through the Physician Practice, docs got office space on campus plus paychecks with all of the fringe benefits. A lot of them also maintained private practices off premises. Plenty of docs did all three Stations of the Cross. Some even did research under grant through the university. Double, triple, even quadruple dipping, it was a sweet deal also for the university to field an All Star team. We billed outpatient fees-for-service through the hospital.

Patients came to the Physician Practice through hospital referrals, typically on discharge from the in-patient service, where specialists do a lot of cross-referring to each other. The Physician Practice also brought in patients from the community to what was perceived as a prestige brand. It was my job to worry about the hospital’s deficit from 3rd party reimbursements that didn’t even come close to covering our operating costs, never mind the Ivy League overhead.

What I had going for me in negotiating reimbursement rates with insurance companies was Columbia-Presbyterian Hospital’s footprint on their population. It wasn’t like I could credibly threaten to pull the plug but – should push ever come to shove – whoever did their negotiating cared more about losing than we did, if for no other reason than because the university’s top guns were individually and personally bullet proof. No theory of economics or law is worth the paper it’s written on – even U.S. Supreme Court stationery – if it doesn’t get the power dynamics right in corporate politics.

“BILL BABY, BILL”

Since so many referrals to the Physician Practice came from our in-patient service – where contractual arrangements were already in place and where the bills were orders of our outpatient fees-for-service magnitude – it wasn’t like the insurance companies could give me the same bum’s rush as they gave to a solo physician in private practice. Even though I had zero fiscal or administrative contact with the in-patient side, except for the data center’s hot line, insurance companies had to give at least a little on reimbursements, because heavyweights pack more power in their punches.

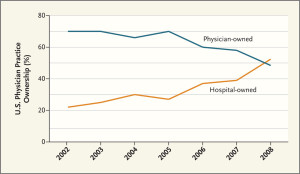

“For hospitals, buying or affiliating with practices allows development of areas of excellence, ensures staff, provides a network of referrals from physicians, and can give the combined entity more leverage with insurers. Affiliation in the form of a joint venture such as an outpatient center can be a way for the hospital to increase revenues and ward off competition from independent doctors and practices that open such centers.” (Suzanne M. Kirchhoff in “Physician Practices: Background, Organization, and Market Consolidation” for the Congressional Research Service published on January 2, 2013)

I’ve never personally come across a hospital on the war path to “ward off competition from independent doctors and practices that open such centers”, even later as Practice Manager with equity in a privately owned and operated outpatient medical center. It’s the origin of in-patient (hospital) species, rather, to get referrals from physicians, who practice in the surrounding community. It’s also much more mutually beneficial for such physicians to be granted privileges, where they’re hospitalizing patients, in order to maintain a continuum of care. Think about an OB/GYN practice, for example, where an expectant mother transitions from pre-natal to birth to post-partum and picks up a pediatrician along the way. Not to say there’s no predatory competition but rather that there’s some inevitable pain for the gain.

“It is more profitable [in ‘Accommodated Entry’] for the incumbent to engage in strategic behavior that accommodates profitable entry but limits the profitability of entry at other than small scale. Here the incumbent sacrifices some short-term pre-entry profits to reduce the scale of entry to keep prices higher than they would be if entry occurred at large scale.” (“Regulation of Natural Monopolies”)

Whether some hospital administrations are more strategic in their calculations, the overhead burden leaps logarithmically in going from individual to institutional. Take the multi-million dollar diagnostic imaging investments in MRI equipment, CT scanners and mammography machines. While Generally Accepted Accounting Principles (GAAP) might require these investments to be booked as depreciable assets – or sunk costs in the economist’s lexicon – they’re the production technology in a diagnostic medical imaging practice. All kinds of direct costs also go into every shift to operate these machines, before you even begin to pick up a share of the hosting overhead. So a prodigal physician coming out of the womb gets slapped on the ass and told to “bill baby bill”.

Production technology shapes industrial organization. Where the competition is for economies of scale, it doesn’t get any better than bigger. “Economies of scale are factors that cause the average cost of producing something to fall as the volume of its output increases…Economies of scale were the main drivers of corporate gigantism in the 20th century.” (“Economies of Scale and Scope” in The Economist on October 20, 2008)

It’s a simple matter of number crunching to cost out medical procedures and, as a matter of fact, every Institutional Health Care Facility’s (IHCF) ledger is an open book for the U.S. Department of Health and Human Services for just such a purpose. The Healthcare Cost Report Information System (HCRIS) contains annual reports submitted by institutional providers to Medicare. It provides information to CMS that assists with the annual settlement summary between CMS and the institutional provider. The cost report information includes facility level:

Utilization Statistics

Costs

Charges

Medicare Payments, and

Financial Information.

For more information or to download these data, please visit the CMS website: http://www.cms.gov/Research-Statistics-Data-and-Systems/Files-for-Order/.

COMPETITIVE DYNAMICS AT THE HEART OF TRANSPLANTS

What useful information does arithmetic reveal about competitive pricing in the practice of medicine? The first successful heart transplants were medical miracles. They were also life savers. For someone needing a heart transplant, it was a question of “what do I have to pay for this life saver?” rather than what does it cost to do one of these medical procedures? From every corner of the globe – for whatever it “costs” – those with cancer who can afford it come to Memorial Sloan-Kettering Cancer Center.

“[Allyn] Young, when considering increasing returns [to the division of labor], does not refer to the exploitation of economies of scale, but to economies of specialization in relation to the extent of the market…[T]he capital-labor ratio chosen by the firms depends on the extent of the market and not on relative factor prices…[T]he main question is the presence of an outlet for the increased production…

Every important advance in the organisation of production, (not only technical progress)…alters the conditions of industrial activity and initiates responses elsewhere in the industrial structure which in turn have a further unsettling effect. This change becomes progressive and propagates itself in a cumulative way’.” (“Division of Labor and Economic Growth” by Andrea Mario Lavezzi in a paper prepared for the Conference on Old and New Growth Theories in Pisa from October 5-7, 2001)

Costing out everything in the practice of medicine and dividing by the number of procedures still refers back in the transactional ledger to measures of effective demand or actual spending on fees-for-service. Even where physicians work on salary – which are period costs rather than transactional expenses on the accounting books – what remains for medical providers net of all costs are the incentives in a competitive dynamic from the surplus of value that consumers pay them.

Reimbursing medical providers exclusively on the basis of arithmetic costs, government (Medicare and Medicaid) substitutes subsistence rations for the surplus of value in a heart transplant or a cancer treatment.

Instead of referring to any competitive dynamic at the heart of transplants or cancer cures, political imperatives operate on appropriations from the public purse.

Intermediaries between medical providers (suppliers) and patients (consumers) – meaning insurance companies – squeeze some of that same value out of the surplus through a displacement of incentives by virtue of their own profit motives in combination with their bargaining power of the purse.

“Payers have incentives to complicate billing; they can shift costs by issuing incomprehensible or inaccurate invoices and by delaying or disputing payment. They also have incentives to shift costs or reduce services by putting roadblocks between patients and care providers, restricting patients’ access to expensive treatments and most out-of-network treatments. (Although out-of-network care is not inherently more expensive, hospitals charge out-of-network patients list prices that may be twice as high as negotiated in-network prices. The difference between the amount the payer will reimburse and the artificially high list prices essentially makes out-of-network care prohibitively expensive for many patients.)” (“Redefining Competition in Healthcare” by Michael E. Porter and Elizabeth Olmstead Teisberg in Harvard Business Review)

“The top priority of for-profit [health insurance] companies is to drive up the value of their stock…[I]nvestors and analysts look for two key figures: earnings per share and the medical-loss ratio, or medical “benefit” ratio, as the industry now terms it. That is the ratio between what the company actually pays out in claims and what it has left over to cover sales, marketing, underwriting and other administrative expenses and, of course, profits…[F]or-profit insurers must prove that they made more money during the previous quarter than a year earlier and that the portion of the premium going to medical costs is falling…[I]nsurers routinely dump policyholders who are less profitable or who get sick. Insurers have several ways to cull the sick from their rolls. One is policy rescission…They also dump small businesses whose employees’ medical claims exceed what insurance underwriters expected…The practice is known in the industry as ‘purging’. The purging of less profitable accounts through intentionally unrealistic rate increases helps explain why the number of small businesses offering coverage to their employees has fallen from 61 percent to 38 percent since 1993, according to the National Small Business Association. Once an insurer purges a business, there are often no other viable choices in the health insurance market because of rampant industry consolidation…A study conducted last year by PricewaterhouseCoopers revealed just how successful the insurers’ expense management and purging actions have been over the last decade in meeting Wall Street’s expectations. The accounting firm found that the collective medical-loss ratios of the seven largest for-profit insurers fell from an average of 85.3 percent in 1998 to 81.6 percent in 2008. That translates into a difference of several billion dollars in favor of insurance company shareholders and executives and at the expense of health care providers and their patients.” (“A Health Insurance Insider Blows the Whistle on the Industry’s Abusive Practices” in the testimony of former medical insurance industry executive Wendell Potter on “Consumer Choices and Transparency in the Health Insurance Industry” before the U.S. Senate Committee on Commerce, Science and Transportation on June 24, 2009)

Russ Britt did a tour on Market Watch in the Wall Street Journal to report “Health Insurers Build Market Clout: Study Confirms Health Monopoly Fears” on April 17, 2006:

“Data from the American Medical Association shows that in each of 43 states, a handful of top insurers have gained such a stronghold that their markets are considered “highly concentrated” under Department of Justice guidelines, often far exceeding the thresholds that trigger antitrust concerns. The study also shows that in 166 of 294 metropolitan areas, or 56%, a single insurer controls more than half the business in health maintenance organization (HMO) and preferred provider networks (PPO) underwriting…

The AMA study is the latest piece of evidence – and most comprehensive to date – showing the market power of a few companies…is formidable and growing. And it comes at a time when premiums continue to grow at near double-digit rates.

Critics say that carriers are not only creating monopolies and oligopolies in many regions, they also control the other side of the equation in what is known as monopsony power. That means in addition to having the most enrollees, they’re also the biggest purchasers of health care and can dictate prices and coverage terms… Rate increases, though slowing, are higher than ever and growing at a near double-digit pace.”

There’s a little bit of a disconnect between academic doctrine in its focus on “factors that cause the average cost of producing something to fall as the volume of its output increases” and forcing facts to fit an intuitively plausible theory, as in “competition is the root of the problem with U.S. health care performance…It involves the pursuit of greater bargaining power rather than efforts to provide better care.” (“Redefining Competition in Healthcare”) “Competition at the wrong level has been exacerbated by pursuit of the wrong objective: reducing cost.”

Theories that set out to explain facts don’t prove causality though guilt by association. It’s a fact I’d been hired, for example on the composite theory that “pursuit of greater bargaining power” would go at least some ways towards reimbursing us for the cost not just “to provide better care” but, in our minds, the best possible care. I’d probably have smoked less and consumed less antacid, by the same token, if there’d been any visible – never mind strategic – “pursuit of the…objective: reducing cost”. Despite plenty of competition in NYC, probably more than anywhere else in the U.S. if not the entire world, we aimed to be competitive by trying to get enough revenue through reimbursements to cover our costs.

“First postulated by Adam Smith in his seminal work, The Wealth of Nations in 1776, the ‘invisible hand’ or first welfare theorem confirmed a surprising, yet intuitive axiomatic inference that free markets – whilst appearing somewhat chaotic, channel an economic system to reach the correctly required level of production noting that; ‘it is not from the benevolence of the butcher, the brewer, or the baker that we expect our dinner, but from their regard to their own interest’.” (“Free Market Efficiency: Conditions, Desirability, Optimality”)

“The most fundamental and unrecognized problem in U.S. health care today is that competition operates at the wrong level. It takes places at the level of health plans, networks, and hospital groups. It should occur in the prevention, diagnosis, and treatment of individual health conditions or co-occurring conditions.” (“Redefining Competition in Healthcare”)

“Competition at the level of individual health conditions” – in my later experience as Practice Manager for an outpatient medical center with a preponderantly Medicaid population – produces the worst outcomes where there’s the least reimbursement to recover costs. An R.N. on the staff of NYS Department of Health told me, for example, that Hepatitis C was contagious in the Jackson Heights community as a result of infection from local doctors’ offices. Although undocumented aliens could walk into any NYC municipal hospital’s E.R., no questions asked, the Pakistani community’s Imam told me about someone, who’d died from a burst appendix, because the practice of outpatient medicine just doesn’t reach into this population. Separate and apart from the politics of illegal immigration, there’s no mercy rule in the market dynamics of economic competition. From “Rationing, Signaling and Incentives” in Economics Online:

“The interaction of buyers and sellers in free markets enables goods, services, and resources to be allocated prices. Relative prices, and changes in price, reflect the forces of demand and supply…

The Incentive Function of the Price Mechanism

An incentive is something that motivates a producer or consumer to follow a course of action or to change behaviour. Higher prices provide an incentive to existing producers to supply more because they provide the possibility of more revenue and increased profits.

The Signaling Function of the Price Mechanism

Price changes send contrasting messages to consumers and producers about whether to enter or leave a market. Rising prices give a signal to consumers to reduce demand or withdraw from a market completely, and they give a signal to potential producers to enter a market. Conversely, falling prices give a positive message to consumers to enter a market while sending a negative signal to producers to leave a market. For example…the provision of ‘free’ healthcare may signal to ‘consumers’ that they can pay a visit to their doctor for any minor ailment, while potential private healthcare providers will be deterred from entering the market.”

The way it went down in the Physician Practice at Columbia University’s College of Physicians and Surgeons, no patient got past the front desk without first arranging for payment. We’d have preferred to get our full fees-for-service but reality bites. Much as we connected directly with patients through the standard of our medical practice, their insurance policies paid our bills. So we cut price – discounted fees-for-service – with insurance companies in exchange for a stable flow of reimbursements that were remitted to us pretty much when they were supposed to be, instead of our having to keep a lot of barbers on staff for the inevitable haircuts.

Out of Pocket (private pays) occupy a place in the food chain, where might makes the right to eat small potatoes = $322.7 billion or 11.1% of $2.915.5 billion projected HCE in 2013. Of the $925.2 billion in private 3rd party payments, though, employers aren’t writing any blank checks for medical insurance premiums. So, private demand at the pump is elastic enough to queue on price for fuel consumption.

“Providers also compete to see who can form the largest, most powerful group, able to offer a complete array of services…Provider groups are formed not to create value but to boost bargaining power vis-à-vis health plans and other system participants.” (“Redefining Competition in Healthcare”)

With $2,592.8 trillion = 88.9% of aggregate spending on health care likely to be disbursed in 2013 by 3rd party payers (“National Health Expenditure Projections: 2011-2021”), “bargaining power vis-à-vis health plans and other system participants” for a share of the 50% going through private purses is the preferred alternative to biting down hard on government rations.

“As a result of the increased growth in federal spending and the slowdown in all other spending, the Federal share of the national health expenditures increased sharply…Household, private business and state and local governments’ health spending share of NHE each declined…The proportion of health spending sponsored by private business decreased…to 22 percent for 2007 and 2008…[T]he household share of spending…declined slightly to 28 percent in 2009.” (“Sponsors of Health Care Costs: Business, Households, and Governments, 1987 – 2009”)

From our monthly operating statements and really no more than a pulse on patient volume, whatever discounts went to seal the reimbursement deals with insurance companies got plugged back into our baseline fees-for-service on the venerable premise that “you can’t always get what you want but, if you try sometimes…you get what you need”. So the deficit would cycle back continuously into our price matrix on the budgeting theory that we’d eventually get enough reimbursements to spare us from overdrawing the checking account, which never happened, only because the university’s endowment fund was like an open line of credit that never asks to be repaid.

Bailing ourselves out of a negotiated discount dunking with a wish list price pail, how much more wishful do the fees-for-service have to be – in the aggregate – with so much deeper discounts on a scale of Medicare’s and Medicaid’s enrollment? The Medicare and Medicaid population was referred – for this reason – to hospital clinics. I’d personally done the math. With what Medicare and Medicaid paid – let me put it like this – if a blue chip Physician Practice can’t cover the overhead, which includes the electric bills, then neither will it be able to keep the lights on.

“Brooklyn is close to losing two large and historic hospitals, and others might not be far behind. Local economics, politics and long-range health care trends that have been shuttering hospitals around the region for decades could claim more Brooklyn institutions in the years ahead. Interfaith Medical Center, which has been in bankruptcy since December, told a federal judge late last month that it would begin winding down operations in mid-August, end inpatient admissions a month later and finish outpatient procedures by mid-October. The hospital, formed by a merger of Brooklyn Jewish Medical Center and St. John’s Episcopal Hospital, has been in operation in the Bedford-Stuyvesant neighborhood for more than a century…Four miles away in the Cobble Hill neighborhood, the State University of New York has been trying to shut Long Island College Hospital since March. The SUNY Downstate network of three hospitals and five colleges of medicine and related fields has been losing tens of millions of dollars a year, and officials say selling off LICH is crucial to overhauling the system…Also precariously positioned is Wyckoff Heights Medical Center in Bushwick…In the last six years, at least nine hospitals in the city have closed – including two that have been acquired by rival systems and turned into outpatient centers. Most were in relatively poor communities. A handful were in affluent areas but served as ‘safety-net’ facilities, because local residents who were wealthy and insured favored other facilities farther away…[New York State Governor] Cuomo and state officials have refused to continue subsidizing the hospitals as they are to keep them open. Instead, state officials want to change the mix of services in Brooklyn, where 1 million people are covered Medicaid. ‘Our challenge is to find the means to modernize and downsize these hospitals (where it makes sense) and to develop community-based, ambulatory care infrastructure as rapidly as possible,’ Cuomo wrote.” (“Cascading Hospital Closures Loom Over Brooklyn” by Fred Mogul of WNYC in Kaiser Health News on August 5, 2013)

“A monopsony consists of a market with a single buyer. When there are only a few buyers, the market is defined as an oligopsony…In general, when buyers have some influence over the price of their inputs they are said to have monopsony power…One common use of the notion of monopsony power arises in the context of defining market structure. For example, in cases where monopoly power is the issue, it may be useful to examine the extent to which such power is offset by powerful buyers. This is sometimes referred to as countervailing power. The ability of a firm to raise prices, even when it is a monopolist, can be reduced or eliminated by monopsony” (“Glossary of Statistical Terms: Definition of Monopsony in Industrial Organisation Economics and Competition Law”, compiled by R. S. Khemani and D. M. Shapiro, commissioned by the Directorate for Financial, Fiscal and Enterprise Affairs, OECD, 1993)

BITING DOWN HARD ON GOVERNMENT RATIONS

Where government sets (or suppresses) price on 50% of all health care spending – enough to dominate a market – economic imperatives are going to read the signals and act on the incentives. Since government mandates are non-negotiable, right there is a built in incentive to influence these mandates at their legislative and regulatory sources.

Government’s subsistence pricing displaces the profit motive to unregulated markets that are both more hospitable and more remunerative to enterprise. One hundred percent of these profit motives double down effectively on half of residual (spending) demand. In a government sponsored chase to the highest price, big surprise if that’s what you get. It’s just common sense to try making up for lost ground.

“[A]lthough a free market system results in a Pareto-efficiency, this can only occur under very restrictive idealised conditions that are unlikely to be realised in practice…[E]ven under a decentralised economic system, [there are] a number of possible distortions where marginal social costs and marginal social benefits are not equated and can result in market failures that affect the efficiency and quality of a free market in the allocation of resources…In the extreme of production control…any divergence from the perfectly competitive model can cause an excessively high price in the market that creates an inefficient Dead Weight Loss (DWL) for society.” (“Free Market Efficiency: Conditions, Desirability, Optimality”)

Concentration in the government’s power of the purse – along with medical insurers’ intermediary power of the private purse – unambiguously signals to providers an arms race on the disincentive of their vulnerability to getting steam rolled.

“Another form of unproductive competition occurs when providers compete to be included in health plan networks by giving deep discounts to payers and employers that have large patient populations…Large discounts in return for increased overall patient flow…creates artificial benefits for large groups and shifts costs to small groups, unaffiliated individuals, patients seeking out-of-network care, and the uninsured…[T]he objective has often not been to reduce the total cost of health care but to reduce the cost that is borne by the system’s intermediaries—health plans or employers”. (“Redefining Competition in Healthcare”)

Everything happens for a reason. There’s a reason why the horse pulls the cart, for example, instead of going through life ass forward. Employer-based medical insurance started, as a matter of fact, with Blue Cross selling coverage to Texas teachers in the 1920s and went viral because of government wage & price controls in combination with IRS tax breaks. From “Accidents Of History Created U.S. Health System”, by Alex Blumberg and Adam Davidson on “All Things Considered” in a National Public Radio broadcast on October 22, 2009:

“In 1900, the average American spent $5 a year on health care ($100 in today’s money). No one had health insurance, because you don’t need insurance for something that costs $5 a year.

Before the birth of modern medicine, hospitals were poorhouses where the indigent went to die. Then came the advent of effective medicines, especially antibiotics, along with a revolution in medical schools. Suddenly, says economic historian Melissa Thomasson, ‘hospitals are marketing themselves as places to have babies’…

By the late 1920s, hospitals noticed most of their beds were going empty every night. They wanted to get people who weren’t deathly ill to start coming in. An official at Baylor University Hospital in Dallas noticed that Americans, on average, were spending more on cosmetics than on medical care…

The Baylor hospital started looking for a way to get regular folks in Dallas to pay for health care the same way they paid for lipstick — a tiny bit each month. Hospital officials started small, offering a deal to a group of public school teachers in Dallas. They offered a plan for the teachers to pay 50 cents each month in exchange for Baylor picking up the tab on hospital visits.

When the Great Depression hit, almost every hospital in the country saw its patient load disappear. The Baylor idea became hugely popular. It eventually got a name: Blue Cross. ‘When I actually started studying this stuff, I got interested because I wondered why we have an employer-based system,’ Thomasson says. ‘It comes right out of Blue Cross.’ The genius of that approach, she says, was marketing it to groups of workers…

The modern system of getting benefits through a job required another catalyst: World War II. Thomasson says that if the Great Depression inadvertently inspired the spread of employer-based health insurance, World War II accidentally spread the idea everywhere. ‘The war economy is an entirely different ballgame,’ Thomasson says. The government rationed goods even as factories ramped up production and needed to attract workers. Factory owners needed a way to lure employees. She explains that the owners turned to fringe benefits, offering more and more generous health plans.

The next big step in the evolution of health care was also an accident. In 1943, the Internal Revenue Service ruled that employer-based health care should be tax free…

Thomasson cites the huge impact of those measures on plan participation. ‘You start from 9 percent of the population in 1940 to 63 percent in 1953,’ she says. ‘Everybody starts getting in on it. It just grows by gangbusters. By the 1960s, 70 percent [of the population] is covered by some kind of private, voluntary health insurance plan’.” Then came Medicare and Medicaid.

WHEN GOVERNMENT GIVES PRICE A HOLIDAY

EVERYONE ELSE GETS UNINVITED GUESTS

Consumption trends towards infinity without the disincentive of entitled consumers having to pay for it. “A public good, as defined by economic theory, is a good that, once produced, can be consumed by an additional consumer at no additional cost. A second characteristic is sometimes added, specifying that consumers cannot be excluded from consuming the public good once it is produced…Economists define a public good as a good having one or both of the characteristics of non-excludability and jointness in consumption. Non-excludability means that it is difficult to keep people from consuming the good once it has been produced, and jointness in consumption means that once it is produced for one person, additional consumers can consume at no additional cost. Goods that are joint in consumption are also called collective-consumption goods or nonrival consumption goods.” (“A Theory of Public Goods”)

“The financial burden of health care costs resides with the private business, households, and governments that pay insurance premiums, out-of-pocket costs, or finance health care through dedicated taxes or general revenues. These payers…decide what health care plans are offered, who is eligible to participate in the plan, what cost-sharing arrangements (premiums, co-payments, and deductibles) will be imposed, and how much coverage will be available. The sponsors of health care costs collect the money and are responsible for financing the payers.” (The U.S. Government’s Centers for Medicare and Medicaid Services “Sponsors of Health Care Costs: Business, Households, and Governments, 1987 – 2009”)

When any government runs deficits in its capacity as sponsor, borrowing instead of taxing the population for collective ‘public good’ consumption, the electorate in a representative democracy abdicates – or at the very least postpones – such sponsorship in shifting the burden from citizens to global and institutional investors in government securities. Does not the electorate – as Uncle Sam used to say, “this means you” – bear the moral hazard for everything that happens on its watch? In this country – good, bad or indifferent – it’s not ‘they’ but you who own all outcomes. “Ask not what your country can do for you but what you can do for your country.” (JFK)

Suppliers ration their production capacity under the same regime of a government imposed ceiling on the low end of reimbursable costs. These are price signals to get the most possible economies of scale from production technologies which, in the practice of medicine, means that they’re also incentives to economize if not cheapen the standards of medical practice. “Whenever Americans lapse into their periodic ‘conversations’ on health reform, a single-payer health system is proposed by some as the panacea and condemned by others as ‘socialised medicine’.” (“Why Single-Payer Health Systems Spark Endless Debate” by Uwe E. Reinhardt, James Madison Professor of Political Economy at Princeton University in the British Medical Journal published on April 28, 2007)

“In single-payer health systems, the entire population shares one health insurance carrier…To their proponents, single-payer health systems offer several distinct advantages over pluralistic health insurance systems, such the American system. Firstly, single-payer systems are the ideal vehicle for implementing an egalitarian social ethic, if that is what the citizenry desires. Such systems can apply the same terms of healthcare delivery to all of its citizens, regardless of the patient’s socioeconomic status, including styles of rationing and the fees paid for given treatments…

The built-in pitfalls of single-payer systems, however, must be acknowledged as well. Firstly, single-payer systems allocate disproportionate market power to the buy side of health care, which allows government to keep prices at the minimum necessary to keep providers in the system. Providers understandably may question the fairness of so asymmetric a distribution of market power in a health system. To be sure, the low prices it forces on the system allow society to provide more real health care for a given budget than could be delivered in a more expensive pluralistic system, and it also makes universal health insurance coverage more affordable. On the other hand, the extremely low profit margins it yields the provider of health care makes single-payer systems less hospitable to innovation in healthcare products and services and in the organisation of healthcare delivery, areas in which the United States excels, sometimes to the point of excess.

Secondly, in single-payer systems spending on health care is pitted against other government priorities and easily falls victim to the politician’s perennial desire to campaign on tax cuts.”

With consumption trending towards infinity, specifically because price is administratively thwarted from clearing the market, it is a mathematical certainty that aggregate spending will trend in the same direction. Market Failure is a condition brought about by “interdependences that are external to the price system, hence unaccounted for by market valuations…What is it that gives rise to ‘direct [non-price] interaction’, to short circuit, as it were, of the signaling system?…[It is] ‘the divorce of scarcity from effective ownership’.” (“The Anatomy of Market Failure” by Francis M. Bator in The Quarterly Journal of Economics, Vol. 72, No. 3, August, 1958, published by The MIT Press) “[W]here public good phenomena are present, there does not exist a set of prices…which would induce profit seeking competitors to produce the optimal bill of goods…There is [market] failure” in any government policy that defies the scarcity of resources.

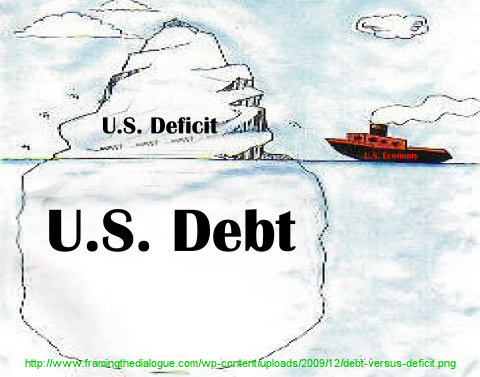

“[T]he problem is the immense burden that our health-care entitlement programs present for the nation’s future. The numbers are depressing and staggering. A decade from now, our national debt will be as large as our entire economy — a level of debt we have not seen since the immediate aftermath of the Second World War — and (unlike the late 1940s) it will be on a trajectory of persistent ballooning growth. By 2035, according to the Congressional Budget Office, the debt will be twice the size of the economy and still expanding quickly. The resulting much-diminished economic growth will cast a great shadow over the prospects of the next generation, which will be unable to experience anything like the prosperity that Americans have taken for granted over the past 60 years. This is a moral problem at least as much as an economic problem — it is a failure of the present generation to meet its charge to the future.

Our health-care entitlement programs are by far the foremost cause of this coming explosion of debt. In its latest long-term projections, published in June, the Congressional Budget Office reported that, between now and 2050, federal spending on health-care entitlements (especially Medicare and Medicaid) will nearly triple as a percentage of the economy, while all other federal spending (including defense, discretionary spending, even Social Security — everything but interest on the debt) will actually decline as a share of the economy. Health-care entitlements are, in short, entirely responsible for our long-term debt problem.” (“Help the Sick and Reduce the Debt: The Moral Economy of the Health-Care Debate” by Yuval Levin for The Witherspoon Institute Public Discourse on August 30, 2011) Never mind the moral hazard of an electorate exempting itself from having to pay through taxation for what its government spends.

PLAY THE PERCENTAGES IN MONEY BALL

The magic wand has yet to be invented that’d stuff this genie back in the lamp without rationing a regime change in health care entitlements.

Of what the U.S. spends on health care, 50% goes to 5% of the population

(A Brief History of Jinn or Genies | Circa71)

“Health care is a scarce resource, and all scarce resources are rationed in one way or another…The case for explicit health care rationing in the United States starts with the difficulty of thinking of any other way in which we can continue to provide adequate health care to people on Medicaid and Medicare, let alone extend coverage to those who do not now have it…Rationing health care means getting value for the billions we are spending by setting limits on which treatments should be paid for from the public purse…When public funds subsidize health care or provide it directly, it is crazy not to try to get value for money…Governments implicitly place a dollar value on a human life when they decide how much is to be spent on health care programs and how much on other public goods that are not directed toward saving lives…It is the familiar comparative exercise of getting the most bang for your buck.” (“Why We Must Ration Health Care” by Peter Singer, Professor of Bio-Ethics at Princeton University, published in The New York Times Magazine on July 15, 2009)

“Estimates of health care expenses for the U.S. civilian non-institutionalized (community) population are critical to policymakers and others concerned with access to medical care and the cost and sources of payment for that care…Medical care expenses, however, are highly concentrated among a relatively small proportion of individuals in the community population…In both 2008 and 2009, the top 5 percent of the population accounted for nearly 50 percent of health care expenditures.” (“STATISTICAL BRIEF #354: The Concentration and Persistence in the Level of Health Expenditures over Time: Estimates for the U.S. Population, 2008-2009” by Steven B. Cohen, PhD and William Yu, MA on the Medical Expenditure Panel Survey for the U.S. Department of Health and Human Services published in January, 2012)

By the time we hit the panic button and brought my widowed mother-in-law back to New York from Florida, she stayed one night in Shorefront Jewish Geriatric Center, before an ambulance rushed her to the ER at Maimonides Medical Center (MMC). She presented there with end stage emphysema from a 60 year two-pack a day habit, plus the docs detected an aortic aneurism that together gave her a very grim prognosis. MMC’s pulmonologist managed to keep her alive – in a vegetative state on a vent with twice daily lung fluid draining – for about two more years. There were intermittent cardiac arrest episodes that had her shuttling from a private room to the CICU and back. In my ex-wife’s capacity as her mother’s medical proxy, both MMC and Medicare conceded to her initiative. I reckoned (from the co-pays) – after my ex-wife finally gave up postponing the inevitable – that the two year concession cost Medicare at least $2,500,000. Who else surrenders their proxy on such a stash of cash?

Rationing health care entitlements touches a sensitive political nerve connecting those who’ve been getting a ‘public good’ for free with those who’ve got to pay for their medical rations and swallow any dissatisfaction.

“Every health care proposal from the right and the left includes some form of implicit rationing device. Mr. Ryan’s plan, on the Republican side, would keep spending on Medicare under 4.75 percent of the nation’s output until 2050 by giving older adults born after 1958 a dollop of money to buy their own insurance, forcing many to choose cheaper plans or fewer procedures.” (“Rationing Health Care More Fairly” by Eduardo Porter in The New York Times published on August 21, 2012)

“[T]he national challenge is spending less on health care in the future, whether or not you call it rationing. The Ryan Plan does it by eliminating Medicare (for all practical purposes) and leaving seniors to depend on their private savings and deliberately underfunded vouchers.” (“Health Care Rationing for Beginners” by James Kwak on The Baseline Scenario: What Happened to the Global Economy and What We Can Do About It published on May 29, 2011)

There is a single-payer system now in place for half of what the U.S. spends on health care. Plus it’s got the biggest source of impending growth locked down. This is like having a pitcher with the league’s best ERA (Earned Run Average) in the bullpen. What possible sense does it make to play partisan hunches instead of money ball? Now you know why Major League Baseball kisses off anyone with skin in the game who does business with the bookies and why the Washington Senators haven’t made it to the World Series since 1933, when they lost three out of four games. Is it going to take another Great Depression for them to keep their eyes on the ball?

“[E]liminating Medicare (for all practical purposes) and leaving seniors to depend on…vouchers” – under, over or fully funded – would be only a partial fix without Medicaid in the mix.

“Historically, the federal share of Medicaid has accounted for the largest share of federal government spending on health…As a result of the current recession that began in December 2007, the federal government again increased the federal share of the Medicaid program in the last quarter of 2008, causing the federal share of Medicaid to increase in 2008 and 2009 while the state and local portion fell.” (“Sponsors of Health Care Costs: Business, Households, and Governments, 1987 – 2009”)

THE MEGA JOLT IN ENTITLEMENTS’ VOLT

If there was an ‘up or down vote’ on any substantive policy issue (besides personal popularity and partisan jihad) – in the closest we’ve recently come to a national referendum (during the 2012 Presidential election campaign) – ‘the third rail of American politics’ got a mega jolt in its ‘entitlements’ volt. Exiting from the national polls 65,917,257 = 61.7% of the Electoral College voted by a plurality of 4,985,022 to change neither the status quo nor the trajectory of government sponsored spending on health care in the U.S. (“2012 Presidential General Election Results” on uselectionatlas.org)

That’s the change you can believe in: the change from campaign to inauguration. Once candidates become incumbents – presidents, congressmen and judges alike – the rule of law applies to everyone, without exemption for conscientious objection. When the United States of America sends troops into battle, it does so as a nation not as a plurality of the electorate. Whoever or whatever any one voted for went into the mix and now comes out of the blender a done deal. The next time around: qué sera, sera. Unless and until then, though, we own the outcome as a nation.

“Economics is not politics. One is a science, concerned with the immutable and constant laws of nature that determine the production and distribution of wealth; the other is the art of ruling…Economic laws are self-operating and carry their own sanctions, as do all natural laws, while politics deals with man-made and man-manipulated conventions. As a science, economics seeks understanding of invariable principles; politics is ephemeral, its subject matter being the day-to-day relations of associated men.” (“Economics versus Politics” excerpted by the Luwig von Mises Institute from The Rise and Fall of Society by Frank Chodorov published in 1959)

The tale of this tape couldn’t possibly be more manifest: we’re cruising for an economic bruising.

Market Failure wins this referendum to cop a nolo contendre plea to premeditated disequilibrium on the Pareto-efficient scale, because it is so often going to be the case that another ‘feasible allocation is preferred by one party’, making ‘further mutually beneficial moves’ not only possible but inevitable.

Family values illustrate how mixing politics with economics can defy logic. I happen to be in a mixed marriage. My wife gets medical insurance from her job. A teacher in NYC’s public schools, it’s a ‘Cadillac’ insurance policy by national standards. I was covered by the same insurance policy until, on my 65th birthday, a Medicare card for me arrived in the mail. If fate should put us side by side in a CICU – both needing a vent to postpone the inevitable in vegetative states – Medicare will write me a blank check, while my wife’s ‘Cadillac’ plan will pull the plug on her probably sooner than later.

For all the trillions of dollars appropriated to afford national compassion for the elderly and indigent – on the premise that they couldn’t otherwise afford it themselves, which is not always the case with Medicare – they’re afforded more than pretty much the entire population working to afford the same salvation from human frailty and mortality.

I bought a medical insurance policy with my payroll deductions, just like my wife does with hers. Whatever happened to “you get what you pay for”?

Notwithstanding 24/7 partisan jihad, pulling the plug on compassion would be like killing the goose that lays golden eggs for campaign contributions on both sides of the aisle, without skipping a beat on corporate welfare entitlements. Follow the damn money: the deficit soars on a scale of not enough having the cojones to pay out of our own pockets for what we spend as a nation on this compassion.

Medicare and Medicaid have to be the only single-payer insurance programs in the world without a mandate to clamp the lid shut on Pandora’s Box.

If we need a law for Medicare and Medicaid to operate within a budget, stop voting for fiscal fools – or worse scam artists – instead of fiscal All Americans.

Don’t be swinging a bat without keeping your eye on the ball, because you ain’t going to score any runs that way. Leo Durocher didn’t actually say “nice guys finish last”, until after he didn’t say it. What Durocher really told Frank Graham of The New York Journal-American about the 1946 New York Giants was: “Take a look at them. They’re all nice guys, but they’ll finish last.” (“Nice Guys Finish Last” on The Phrase Finder posted on April 16, 2004) Graham must’ve been thinking, when he wrote the story, about the Washington Senators.

REFERENCE SOURCES

- “Six things Darwin never said – and one he did”, Darwin Correspondence Project, University of Cambridge ©2013.

- Suzanne M. Kirchhoff in “Physician Practices: Background, Organization, and Market Consolidation” for the Congressional Research Service published on January 2, 2013.

- “Regulation of Natural Monopolies” from Paul L. Joskow’s work in the Department of Economics at Massachusetts Institute of Technology, later published in the Handbook of Law and Economics, 2007, vol. 2, Chapter 16, pp. 1227-1348.

- “Economies of Scale and Scope” in The Economist on October 20, 2008.

- The U.S. Department of Health and Human Services Health Care Cost Report Information System.

- “Division of Labor and Economic Growth” by Andrea Mario Lavezzi in a paper prepared for the Conference on Old and New Growth Theories in Pisa from October 5-7, 2001.

- “Health Insurers Build Market Clout: Study Confirms Health Monopoly Fears” by Russ Britt on Market Watch in the Wall Street Journal published on April 17, 2006.

- “Redefining Competition in Healthcare” by Michael E. Porter and Elizabeth Olmstead Teisberg in the Harvard Business Review.

- “A Health Insurance Insider Blows the Whistle on the Industry’s Abusive Practices” in the testimony of former medical insurance industry executive Wendell Potter on “Consumer Choices and Transparency in the Health Insurance Industry” before the U.S. Senate Committee on Commerce, Science and Transportation on June 24, 2009.

- “Free Market Efficiency: Conditions, Desirability, Optimality”, an Economic Discussion Paper by George Mendes for The Strategy Tank.

- “Rationing, Signaling and Incentives” in Economics Online.

- “Cascading Hospital Closures Loom Over Brooklyn” by Fred Mogul of WNYC in Kaiser Health News on August 5, 2013.

- “Glossary of Statistical Terms: Definition of Monopsony in Industrial Organisation Economics and Competition Law”, compiled by R. S. Khemani and D. M. Shapiro, commissioned by the Directorate for Financial, Fiscal and Enterprise Affairs, OECD, 1993.

- “Accidents Of History Created U.S. Health System”, by Alex Blumberg and Adam Davidson on “All Things Considered”, National Public Radio broadcast on October 22, 2009.

- “Why Single-Payer Health Systems Spark Endless Debate” by Uwe E. Reinhardt, James Madison Professor of Political Economy at Princeton University in the British Medical Journal published on April 28, 2007.

- The U.S. Government’s Centers for Medicare and Medicaid Services “Sponsors of Health Care Costs: Business, Households, and Governments, 1987 – 2009”.

- “The Anatomy of Market Failure” by Francis M. Bator in The Quarterly Journal of Economics, Vol. 72, No. 3, August, 1958, published by The MIT Press.

- “Help the Sick and Reduce the Debt: The Moral Economy of the Health-Care Debate” by Yuval Levin for The Witherspoon Institute Public Discourse on August 30, 2011.

- “Why We Must Ration Health Care” by Peter Singer, Professor of Bio-Ethics at Princeton University, published in The New York Times Magazine on July 15, 2009.

- “STATISTICAL BRIEF #354: The Concentration and Persistence in the Level of Health Expenditures over Time: Estimates for the U.S. Population, 2008-2009” by Steven B. Cohen, PhD and William Yu, MA on the Medical Expenditure Panel Survey for the U.S. Department of Health and Human Services published in January, 2012.

- “Rationing Health Care More Fairly” by Eduardo Porter in The New York Times published on August 21, 2012.

- “Health Care Rationing for Beginners” by James Kwak on The Baseline Scenario: What Happened to the Global Economy and What We Can Do About It published on May 29, 2011.

- “2012 Presidential General Election Results” on uselectionatlas.org.

- “Economics versus Politics” excerpted by the Luwig von Mises Institute from The Rise and Fall of Society by Frank Chodorov published in 1959.

- “Nice Guys Finish Last” on The Phrase Finder posted on April 16, 2004.

ART & PHOTO REFERENCES

- “The Art of Money Getting”: LexisNexis Social Media Visibility.

- “Hospitals Are Hiring More Physicians”: National Center for Policy Analysis.

- Michelangelo’s “The Last Judgment”: http://www.globaldiscussion.net.

- “The Surplus of Life”: www.allfreelogo.com.

- “The Biggest Purchasers”: http://what-buddha-said.net.

- “Price Signals”: http://www.m4bmarketing.com.

- “Blue Cross”: http://www.seiyaku.com.

- “The Baited Hook”: http://theatheistconservativ.com.

- “Ship of Fools”: Federalism Project | Constitutional Reform and Governance Around the World.

- “Genie in a Bottle”: A Brief History of Jinn or Genies | Circa71.

- “Les Remords de Conscience”, 1930 by Salvador Dali.